Let Me Ask My Wife: Are We Heading Into a Recession?

and what I would invest in if I was allocating for the very first time today

Welcome back to the second installment of Let Me Ask My Wife, my personal finance series, and honestly, what a wild week to be talking about investing!

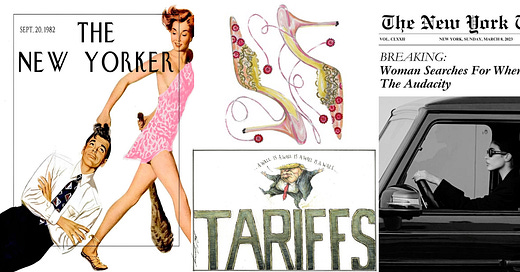

If you’ve been overwhelmed by headlines about tariffs, recession whispers, and the general vibe shift in the economy, you’re not alone. It’s a lot. Trump’s reintroduction of sweeping import tariffs (up to 145% on Chinese goods and a 10% baseline tariff on just about everything else) is already reshaping supply chains and stirring up investor anxiety. Meanwhile, the market has been teetering between “maybe everything is fine?” and “maybe we’re heading into a recession?” It’s a confusing time to be starting your investing journey, but it’s also, strangely, the perfect time.

“When women have money, they have power — and when women have power, they change everything.” Melinda French Gates

This week’s edition is meant to show you how to think clearly when the world feels uncertain, not after it’s all sorted out. Wealth is built when you understand the rules of the game and know how to position yourself even when the scoreboard feels like it’s glitching.

Today, we’ll talk about how to build your first portfolio from scratch — the actual allocation breakdown I’d use if I were just getting started. I’ll also walk you through how I’m personally thinking about all of the headlines and the macro environment (tariffs, inflation, regime-agnostic sectors like AI infrastructure, and also some fun stuff like investing in women’s health).

As always, none of this is financial advice. When investing, always do your own research and make decisions that align with your own financial situation and risk tolerance.

Here’s what you’ll find in this week’s edition:

• Instagram Q&A — your money & investing questions answered

• A mindset reframe to make investing more vibey

• Financial hygiene to form good investing habits

• This week’s investment theses

• What I’d invest in today if I were starting from zero

• The framework I use to build a resilient, values-aligned portfolio

Q: How old were you when you started investing? I'm 24, never invested but really want to. A: I started investing at 21, but fret not! Historically, the average woman has started investing around 32. With younger generations this has gone down, but the average millennial started investing around the age of 25, so you’re right on time! Fun fact that I didn’t know before doing research on this question, the average woman starts investing three years earlier than the average man!

Q: Are we heading into a recession? Should I be scared? A: We might be, and that’s okay. We’re seeing slowing consumer spending, tighter credit conditions, and increased market volatility1 due to things like tariffs and global tension, which are all yellow or orange flags. But it’s important to remember that recessions2 are a normal part of the economic cycle. They’re not fun, but they’re not the end of the world either. You don’t need to be scared, but what you do need is a plan that lets you keep showing up even when the market feels bumpy. That’s what this whole series is about: helping you feel calm, confident, and strategic even when the world feels uncertain.

Mindset & Encouragement — How To Make Investing More Vibey

So many of you asked after last month’s post: how do I make investing feel more vibey? And I get it! Investing should feel fun, not like going to the dentist! You’re literally making money on your own terms — that’s exciting, and it should feel like something you actually want to engage with, not something you avoid or outsource.

Reframe the discomfort. All of the best things in life — love, art, money, impact — involve some form of stretch. You get to decide how much growth you can hold, but know that your ceiling for discomfort often becomes your ceiling for expansion, in every area of life. Learn to breathe through the stretch instead of holding your breath :) And to be regime-specific, this applies to investing too: the times when it feels the scariest, when the news is loud, the markets are red, and everyone is pulling out, are often the times that offer the most opportunity.

Get specific about what you’re manifesting. If you’re calling in $100,000, what is it for? What will it allow you to experience, build, contribute to? How will those things make you feel? Pull up images of them and make a moodboard in Canva, this will expand into life visions as you go. If you want the money to build your own house, make a Canva deck on how you want to design it. If you want it for a business, make a pitch deck for your business. Anchoring your financial goals in beauty and emotion makes the process (and you) magnetic.